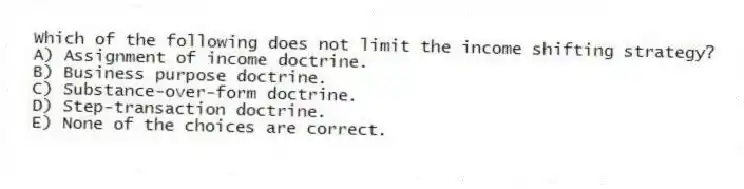

Which of the following does not limit the income shifting strategy?

A) Assignment of income doctrine.

B) Business purpose doctrine.

C) Substance-over-form doctrine.

D) Step-transaction doctrine.

E) None of the choices are correct.

Correct Answer:

Verified

Q65: Assume that Larry's marginal tax rate is

Q66: Assume that Javier is indifferent between investing

Q67: Which of the following may limit the

Q68: Assume that Keisha's marginal tax rate is

Q69: Which of the following is needed to

Q71: Assume that Lavonia's marginal tax rate is

Q72: Which of the following is an example

Q73: Which of the following is an example

Q74: A taxpayer instructing her son to collect

Q75: Which of the following is an example

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents