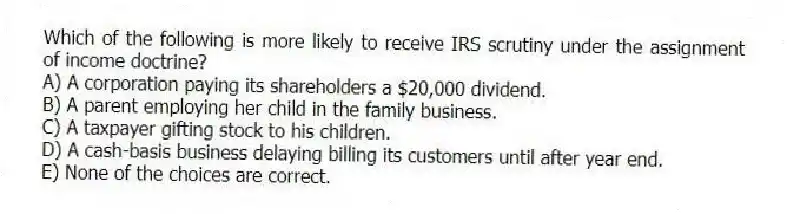

Which of the following is more likely to receive IRS scrutiny under the assignment of income doctrine?

A) A corporation paying its shareholders a $20,000 dividend.

B) A parent employing her child in the family business.

C) A taxpayer gifting stock to his children.

D) A cash-basis business delaying billing its customers until after year end.

E) None of the choices are correct.

Correct Answer:

Verified

Q72: Which of the following is an example

Q73: Which of the following is an example

Q74: A taxpayer instructing her son to collect

Q75: Which of the following is an example

Q76: Jason's employer pays year-end bonuses each year

Q78: Assume that John's marginal tax rate is

Q79: A taxpayer paying his 10-year-old daughter $50,000

Q80: Which of the following is an example

Q81: Danny argues that tax accountants suffer from

Q82: David, an attorney and cash basis taxpayer,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents