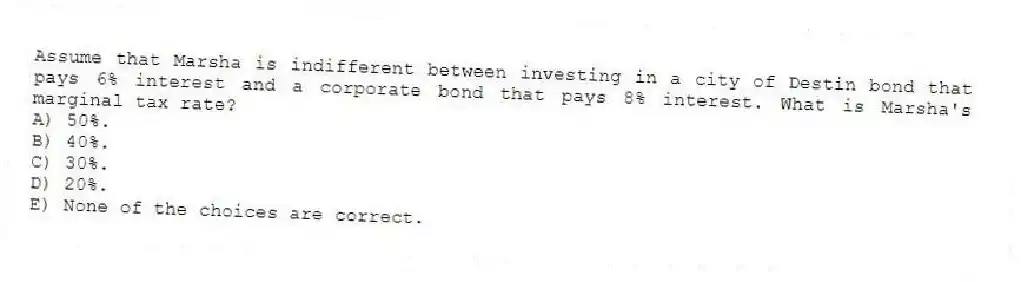

Assume that Marsha is indifferent between investing in a city of Destin bond that pays 6% interest and a corporate bond that pays 8% interest. What is Marsha's marginal tax rate?

A) 50%.

B) 40%.

C) 30%.

D) 20%.

E) None of the choices are correct.

Correct Answer:

Verified

Q57: If Scott earns a 12% after-tax rate

Q58: If Thomas has a 40% tax rate

Q59: Rolando's employer pays year-end bonuses each year

Q60: If Rudy has a 25% tax rate

Q61: Assume that Lucas' marginal tax rate is

Q63: A common income shifting strategy is to:

A)

Q64: Assume that Bill's marginal tax rate is

Q65: Assume that Larry's marginal tax rate is

Q66: Assume that Javier is indifferent between investing

Q67: Which of the following may limit the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents