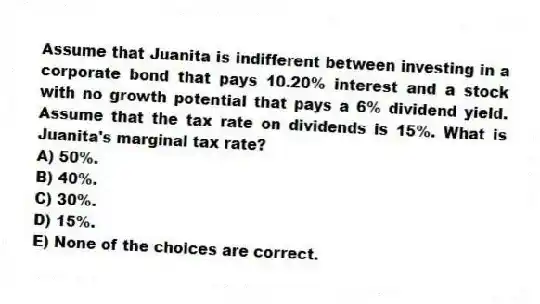

Assume that Juanita is indifferent between investing in a corporate bond that pays 10.20% interest and a stock with no growth potential that pays a 6% dividend yield. Assume that the tax rate on dividends is 15%. What is Juanita's marginal tax rate?

A) 50%.

B) 40%.

C) 30%.

D) 15%.

E) None of the choices are correct.

Correct Answer:

Verified

Q80: Which of the following is an example

Q81: Danny argues that tax accountants suffer from

Q82: David, an attorney and cash basis taxpayer,

Q83: Compare and contrast the constructive receipt doctrine

Q84: There are two basic timing-related tax rate

Q86: Assume that Jose is indifferent between investing

Q87: Assume that Will's marginal tax rate is

Q88: Jared, a tax novice, has recently learned

Q89: Explain why $1 today is not equal

Q90: Luther was very excited to hear about

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents