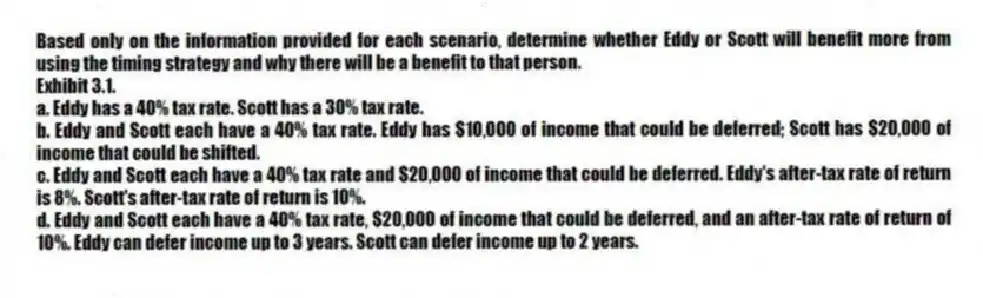

Based only on the information provided for each scenario, determine whether Eddy or Scott will benefit more from using the timing strategy and why there will be a benefit to that person.

Exhibit 3.1.

a. Eddy has a 40% tax rate. Scott has a 30% tax rate.

b. Eddy and Scott each have a 40% tax rate. Eddy has $10,000 of income that could be deferred; Scott has $20,000 of income that could be shifted.

c. Eddy and Scott each have a 40% tax rate and $20,000 of income that could be deferred. Eddy's after-tax rate of return is 8%. Scott's after-tax rate of return is 10%.

d. Eddy and Scott each have a 40% tax rate, $20,000 of income that could be deferred, and an after-tax rate of return of 10%. Eddy can defer income up to 3 years. Scott can defer income up to 2 years.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q88: Jared, a tax novice, has recently learned

Q89: Explain why $1 today is not equal

Q90: Luther was very excited to hear about

Q91: A taxpayer earning income in "cash" and

Q92: Assume that Shavonne's marginal tax rate is

Q94: Based only on the information provided for

Q95: Investing in municipal bonds to avoid paying

Q96: Lucinda is contemplating a long range planning

Q97: The income shifting and timing strategies are

Q98: Paying "fabricated" expenses in high tax rate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents