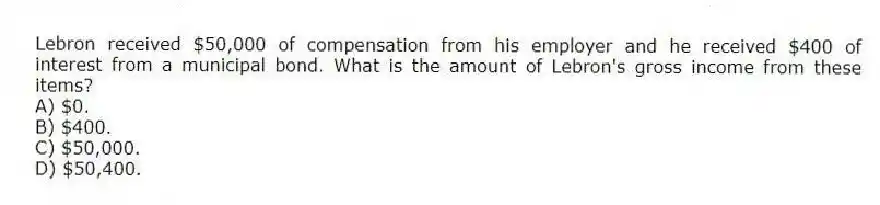

Lebron received $50,000 of compensation from his employer and he received $400 of interest from a municipal bond. What is the amount of Lebron's gross income from these items?

A) $0.

B) $400.

C) $50,000.

D) $50,400.

Correct Answer:

Verified

Q39: For purposes of the dependency exemption qualification,

Q40: To determine filing status, a taxpayer's marital

Q41: Charles, who is single, pays all of

Q42: Eric and Josephine were married in year

Q43: If no one qualifies as the dependent

Q45: It is generally more advantageous from a

Q46: Taxpayers who file as qualifying widows/widowers are

Q47: A taxpayer may not qualify for the

Q48: Which of the following statements regarding exclusions

Q49: It is generally more advantageous for liability

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents