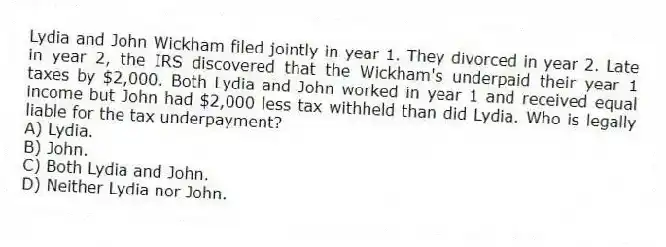

Lydia and John Wickham filed jointly in year 1. They divorced in year 2. Late in year 2, the IRS discovered that the Wickham's underpaid their year 1 taxes by $2,000. Both Lydia and John worked in year 1 and received equal income but John had $2,000 less tax withheld than did Lydia. Who is legally liable for the tax underpayment?

A) Lydia.

B) John.

C) Both Lydia and John.

D) Neither Lydia nor John.

Correct Answer:

Verified

Q90: Katy has one child, Dustin, who is

Q91: Char and Russ Dasrup have one daughter,

Q92: All of the following are tests for

Q93: Which of the following statements about a

Q94: In June of year 1, Edgar's wife

Q96: Earl and Lawanda Jackson have been married

Q97: Michael, Diane, Karen, and Kenny provide support

Q98: Jan is unmarried and has no children,

Q99: Filing status determines all of the following

Q100: In order to be a qualifying relative

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents