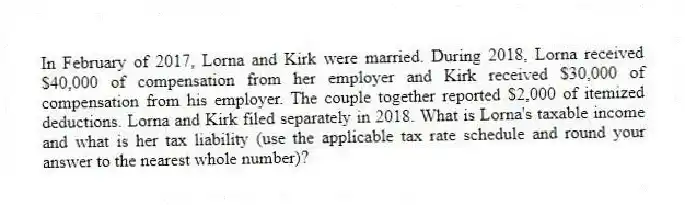

In February of 2017, Lorna and Kirk were married. During 2018, Lorna received $40,000 of compensation from her employer and Kirk received $30,000 of compensation from his employer. The couple together reported $2,000 of itemized deductions. Lorna and Kirk filed separately in 2018. What is Lorna's taxable income and what is her tax liability (use the applicable tax rate schedule and round your answer to the nearest whole number)?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q115: The Dashwoods have calculated their taxable income

Q116: Jane and Ed Rochester are married with

Q117: The Tanakas filed jointly in 2018. Their

Q118: Mason and his wife Madison have been

Q119: John Maylor is a self-employed plumber of

Q120: In April of year 1, Martin left

Q121: By the end of year 1, Harold

Q122: In 2018, Brittany, who is single, cares

Q123: Hannah, who is single, received a qualified

Q125: Doug and Lisa have determined that their

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents