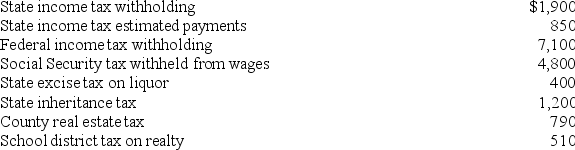

Chuck has AGI of $70,000 and has made the following payments

Calculate the amount of taxes that Chuck can include with his itemized deductions.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q88: Detmer is a successful doctor who earned

Q89: Toshiomi works as a sales representative and

Q90: Karin and Chad (ages 30 and 31,

Q91: Jenna (age 50) files single and reports

Q92: This year Darcy made the following charitable

Q93: Jon and Holly are married and live

Q94: Rachel is an accountant who practices as

Q95: Misti purchased a residence this year. Misti,

Q96: This year Kelly bought a new auto

Q98: Rachel is an engineer who practices as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents