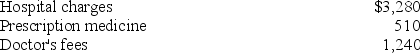

Erika (age 62) was hospitalized with injuries from an auto accident this year. She incurred the following expenses from the accident:

In addition, Erika's auto was completely destroyed in the accident. She bought the car several years ago for $18,000 and it was worth $4,700 at the time of the accident. What are Erika's itemized deductions this year if she was uninsured and her AGI is $40,000?

Correct Answer:

Verified

Th...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q77: Campbell, a single taxpayer, has $400,000 of

Q78: Glenn is an accountant who races stock

Q79: Which of the following is a True

Q80: Last year Henry borrowed $15,000 to help

Q81: Claire donated 200 publicly-traded shares of stock

Q83: Rachel is an engineer who practices as

Q84: Cesare is 16 years old and works

Q85: This year Latrell made the following charitable

Q86: This year, Benjamin Hassell paid $20,000 of

Q87: Rachel is an accountant who practices as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents