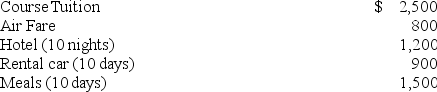

Sam operates a small chain of pizza outlets in Fort Collins, Colorado. In November of this year Sam decided to attend a two-day management training course. Sam could choose to attend the course in Denver or Los Angeles. Sam decided to attend the course in Los Angeles and take an eight-day vacation immediately after the course. Sam reported the following expenditures from the trip:

What amount of travel expenditures can Sam deduct?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q87: Otto operates a bakery and is on

Q88: Bob operates a clothing business using the

Q89: Joe operates a plumbing business that uses

Q90: Murphy uses the accrual method and reports

Q91: Shadow Services uses the accrual method and

Q93: Mike operates a fishing outfitter as an

Q94: Danny owns an electronics outlet in Dallas.

Q95: Gabby operates a pizza delivery service. This

Q96: Colby Motors uses the accrual method and

Q97: Ranger Athletic Equipment uses the accrual method

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents