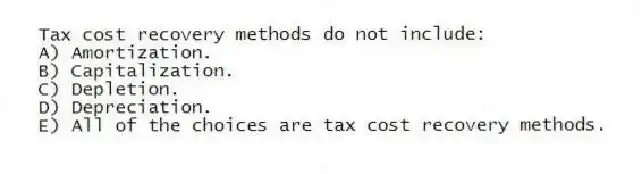

Tax cost recovery methods do not include:

A) Amortization.

B) Capitalization.

C) Depletion.

D) Depreciation.

E) All of the choices are tax cost recovery methods.

Correct Answer:

Verified

Q19: The MACRS depreciation tables automatically switch to

Q20: In general, a taxpayer should select longer-lived

Q21: Bonus depreciation is used as a stimulus

Q22: To increase their depreciation deduction on automobiles,

Q23: All assets subject to amortization have the

Q25: Businesses may immediately expense research and experimentation

Q26: Used property is eligible for bonus depreciation.

Q27: The manner in which a business amortizes

Q28: Cost depletion is available to all natural

Q29: An office desk is an example of:

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents