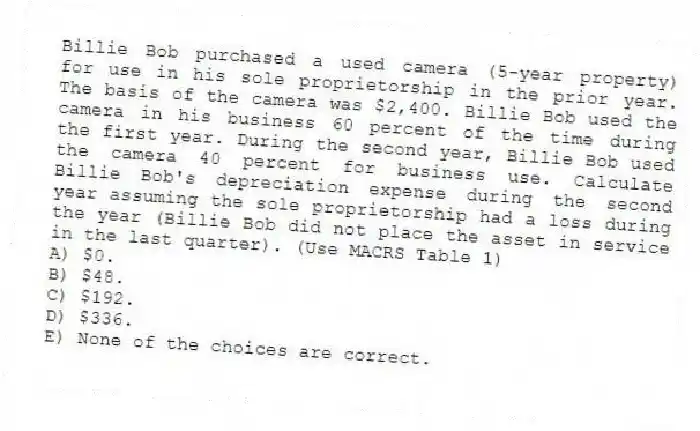

Billie Bob purchased a used camera (5-year property) for use in his sole proprietorship in the prior year. The basis of the camera was $2,400. Billie Bob used the camera in his business 60 percent of the time during the first year. During the second year, Billie Bob used the camera 40 percent for business use. Calculate Billie Bob's depreciation expense during the second year assuming the sole proprietorship had a loss during the year (Billie Bob did not place the asset in service in the last quarter) . (Use MACRS Table 1)

A) $0.

B) $48.

C) $192.

D) $336.

E) None of the choices are correct.

Correct Answer:

Verified

Q69: Jasmine started a new business in the

Q70: Santa Fe purchased the rights to extract

Q71: Which of the following assets is not

Q72: Lenter LLC placed in service on April

Q73: Assume that Bethany acquires a competitor's assets

Q75: Simmons LLC purchased an office building and

Q76: Which of the following assets are eligible

Q77: Daschle LLC completed some research and development

Q78: Arlington LLC purchased an automobile for $55,000

Q79: Gessner LLC patented a process it developed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents