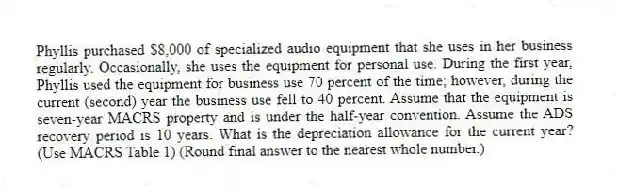

Phyllis purchased $8,000 of specialized audio equipment that she uses in her business regularly. Occasionally, she uses the equipment for personal use. During the first year, Phyllis used the equipment for business use 70 percent of the time; however, during the current (second) year the business use fell to 40 percent. Assume that the equipment is seven-year MACRS property and is under the half-year convention. Assume the ADS recovery period is 10 years. What is the depreciation allowance for the current year? (Use MACRS Table 1) (Round final answer to the nearest whole number.)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q93: Kristine sold two assets on March 20th

Q94: Amit purchased two assets during the current

Q95: Bonnie Jo used two assets during the

Q96: Eddie purchased only one asset during the

Q97: Jaussi purchased a computer several years ago

Q99: During April of the current year, Ronen

Q100: Olney LLC only purchased one asset this

Q101: Alexandra purchased a $55,000 automobile during 2018.

Q102: Boxer LLC has acquired various types of

Q103: Paulman incurred $55,000 of research and experimental

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents