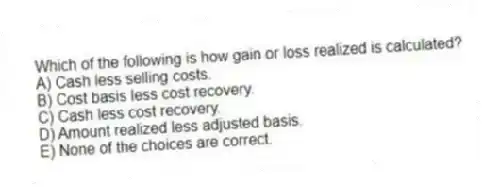

Which of the following is how gain or loss realized is calculated?

A) Cash less selling costs.

B) Cost basis less cost recovery.

C) Cash less cost recovery.

D) Amount realized less adjusted basis.

E) None of the choices are correct.

Correct Answer:

Verified

Q33: The §1231 look-back rule recharacterizes §1231 gains

Q34: A simultaneous exchange must take place for

Q35: The §1231 look-back rule applies whether there

Q36: Realized gains are recognized unless there is

Q37: A taxpayer that receives boot in a

Q39: Which of the following is not True

Q40: Losses on sales between related parties are

Q41: The sale of machinery at a loss

Q42: Leesburg sold a machine for $2,200 on

Q43: Which of the following transactions results solely

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents