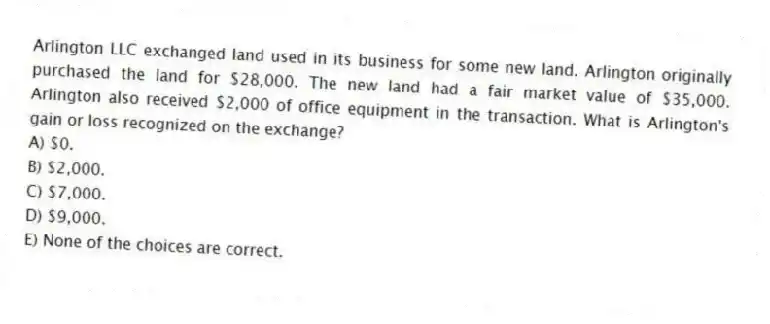

Arlington LLC exchanged land used in its business for some new land. Arlington originally purchased the land for $28,000. The new land had a fair market value of $35,000. Arlington also received $2,000 of office equipment in the transaction. What is Arlington's gain or loss recognized on the exchange?

A) $0.

B) $2,000.

C) $7,000.

D) $9,000.

E) None of the choices are correct.

Correct Answer:

Verified

Q57: Which of the following is not a

Q58: Butte sold a machine to a machine

Q59: The sale of land held for investment

Q60: Brad sold a rental house that he

Q61: Koch traded machine 1 for machine 2 when

Q63: Which one of the following is not

Q64: Which of the following is not True

Q65: Why does §1250 recapture generally no longer

Q66: Each of the following is True except

Q67: Which of the following is True regarding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents