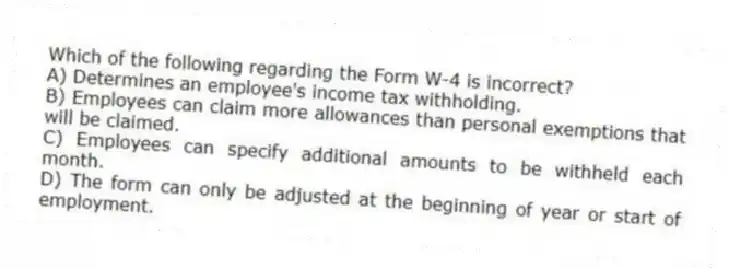

Which of the following regarding the Form W-4 is incorrect?

A) Determines an employee's income tax withholding.

B) Employees can claim more allowances than personal exemptions that will be claimed.

C) Employees can specify additional amounts to be withheld each month.

D) The form can only be adjusted at the beginning of year or start of employment.

Correct Answer:

Verified

Q37: Qualified employee discounts allow employees to purchase

Q38: Taxable fringe benefits include automobile allowances, gym

Q39: Which of the following statements regarding compensation

Q40: Up to $10,000 of dependent care expenses

Q41: Which of the following pairs of items

Q43: Which of the following statements regarding restricted

Q44: Which of the items is not correct

Q45: Maren received 10 NQOs (each option gives

Q46: Which of the following statements regarding income

Q47: When a publicly traded CEO's salary exceeds

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents