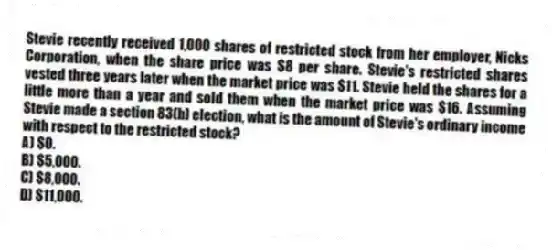

Stevie recently received 1,000 shares of restricted stock from her employer, Nicks Corporation, when the share price was $8 per share. Stevie's restricted shares vested three years later when the market price was $11. Stevie held the shares for a little more than a year and sold them when the market price was $16. Assuming Stevie made a section 83(b) election, what is the amount of Stevie's ordinary income with respect to the restricted stock?

A) $0.

B) $5,000.

C) $8,000.

D) $11,000.

Correct Answer:

Verified

Q67: Which of the following is not a

Q68: Bonnie's employer provides her with an annual

Q69: Tanya's employer offers a cafeteria plan that

Q70: Which of the following is not an

Q71: Grace's employer is now offering group-term life

Q73: Which of the following statements concerning cafeteria

Q74: Which of the following is False regarding

Q75: Which of the following benefits cannot be

Q76: Leesburg paid its employee $200,000 of compensation

Q77: Rachel receives employer provided health insurance. The

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents