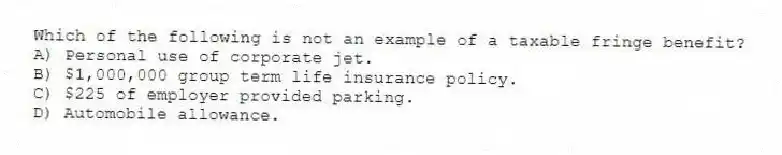

Which of the following is not an example of a taxable fringe benefit?

A) Personal use of corporate jet.

B) $1,000,000 group term life insurance policy.

C) $225 of employer provided parking.

D) Automobile allowance.

Correct Answer:

Verified

Q58: Aharon exercises 10 stock options awarded several

Q59: Bad Brad received 20 NQOs (each option

Q60: Tom recently received 2,000 shares of restricted

Q61: Kevin is the financial manager of Levingston

Q62: Francis works for a local fly fishing

Q64: Big Bucks, a publicly traded corporation, paid

Q65: Hazel received 20 NQOs (each option gives

Q66: Tasha receives reimbursement from her employer for

Q67: Which of the following is not a

Q68: Bonnie's employer provides her with an annual

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents