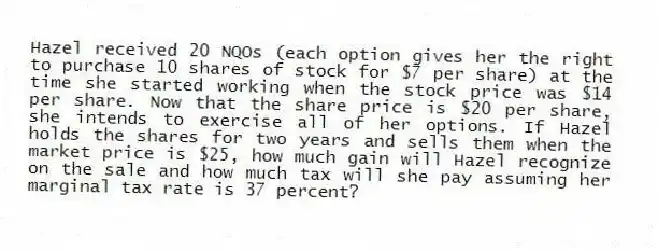

Hazel received 20 NQOs (each option gives her the right to purchase 10 shares of stock for $7 per share) at the time she started working when the stock price was $14 per share. Now that the share price is $20 per share, she intends to exercise all of her options. If Hazel holds the shares for two years and sells them when the market price is $25, how much gain will Hazel recognize on the sale and how much tax will she pay assuming her marginal tax rate is 37 percent?

Correct Answer:

Verified

The gain real...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q91: Rick recently received 500 shares of restricted

Q92: Annika's employer provides only its executives with

Q93: Hope's employer is now offering group-term life

Q94: Annika's employer provides each employee with up

Q95: Corinne's employer offers a cafeteria plan that

Q97: Lina, a single taxpayer with a 35

Q98: Brandy graduated from Vanderbilt with her bachelor's

Q99: Rick recently received 500 shares of restricted

Q100: Raja received 20 NQOs (each option gives

Q101: Lina, a single taxpayer with a 35

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents