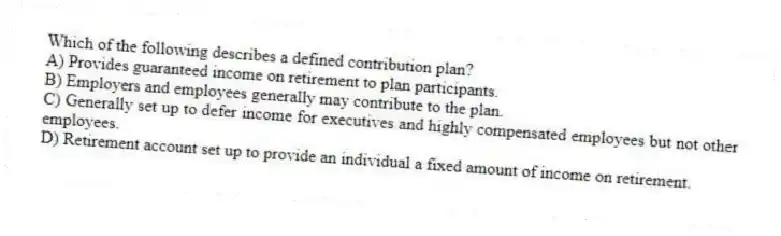

Which of the following describes a defined contribution plan?

A) Provides guaranteed income on retirement to plan participants.

B) Employers and employees generally may contribute to the plan.

C) Generally set up to defer income for executives and highly compensated employees but not other employees.

D) Retirement account set up to provide an individual a fixed amount of income on retirement.

Correct Answer:

Verified

Q18: Jacob participates in his employer's defined benefit

Q19: When a taxpayer receives a nonqualified distribution

Q20: Participating in an employer-sponsored nonqualified deferred compensation

Q21: A SEP IRA is an example of

Q22: Which of the following is a True

Q24: Taxpayers who participate in an employer-sponsored retirement

Q25: Individual 401(k) plans generally have higher contribution

Q26: Qualified distributions from traditional IRAs are nontaxable

Q27: Dean has earned $70,000 annually for the

Q28: If a taxpayer's marginal tax rate is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents