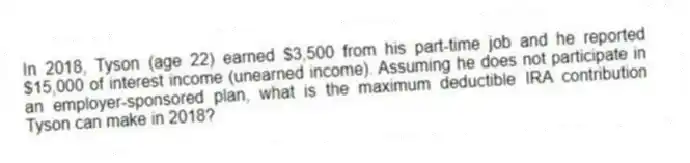

In 2018, Tyson (age 22) earned $3,500 from his part-time job and he reported $15,000 of interest income (unearned income). Assuming he does not participate in an employer-sponsored plan, what is the maximum deductible IRA contribution Tyson can make in 2018?

Correct Answer:

Verified

Deductible co...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q105: Tatia, age 38, has made deductible contributions

Q106: Cassandra, age 33, has made deductible contributions

Q107: In 2018, Tyson (age 52) earned $50,000

Q108: Scott and his wife Leanne (ages 39

Q109: Aiko (single, age 29) earned $40,000 in

Q110: Tatia, age 38, has made deductible contributions

Q111: Deborah (single, age 29) earned $25,000 in

Q113: Katrina's executive compensation package allows her to

Q114: Gordon is a 52-year-old self-employed contractor (no

Q115: In 2018, Madison is a single taxpayer

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents