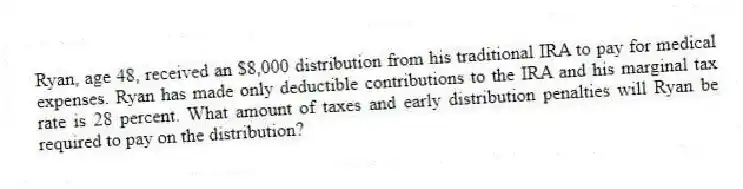

Ryan, age 48, received an $8,000 distribution from his traditional IRA to pay for medical expenses. Ryan has made only deductible contributions to the IRA and his marginal tax rate is 28 percent. What amount of taxes and early distribution penalties will Ryan be required to pay on the distribution?

Correct Answer:

Verified

The full distrib...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q98: Kathy is 60 years of age and

Q99: Henry has been working for Cars Corp.

Q100: Sean (age 74 at end of 2018)

Q101: Katrina's executive compensation package allows her to

Q102: Yvette is a 44-year-old self-employed contractor (no

Q104: Carmello and Leslie (ages 34 and 35,

Q105: Tatia, age 38, has made deductible contributions

Q106: Cassandra, age 33, has made deductible contributions

Q107: In 2018, Tyson (age 52) earned $50,000

Q108: Scott and his wife Leanne (ages 39

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents