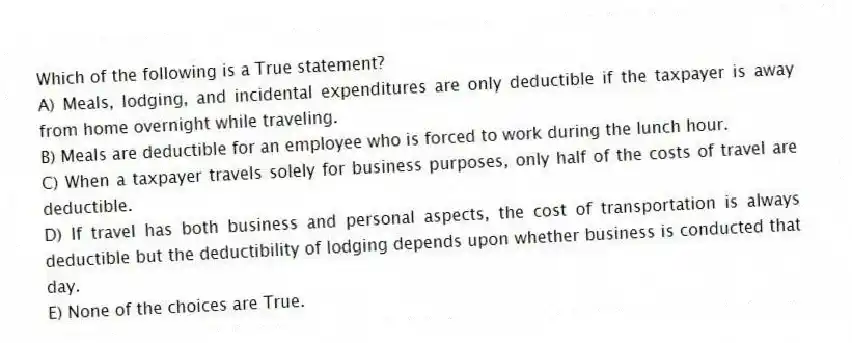

Which of the following is a True statement?

A) Meals, lodging, and incidental expenditures are only deductible if the taxpayer is away from home overnight while traveling.

B) Meals are deductible for an employee who is forced to work during the lunch hour.

C) When a taxpayer travels solely for business purposes, only half of the costs of travel are deductible.

D) If travel has both business and personal aspects, the cost of transportation is always deductible but the deductibility of lodging depends upon whether business is conducted that day.

E) None of the choices are True.

Correct Answer:

Verified

Q42: Bill operates a proprietorship using the cash

Q43: Which of the following is a True

Q44: Clyde operates a sole proprietorship using the

Q45: Shelley is employed in Texas and recently

Q46: When does the all-events test under the

Q48: Colbert operates a catering service on the

Q49: Which of the following is a True

Q50: Ronald is a cash method taxpayer who

Q51: George operates a business that generated revenues

Q52: Which of the following types of transactions

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents