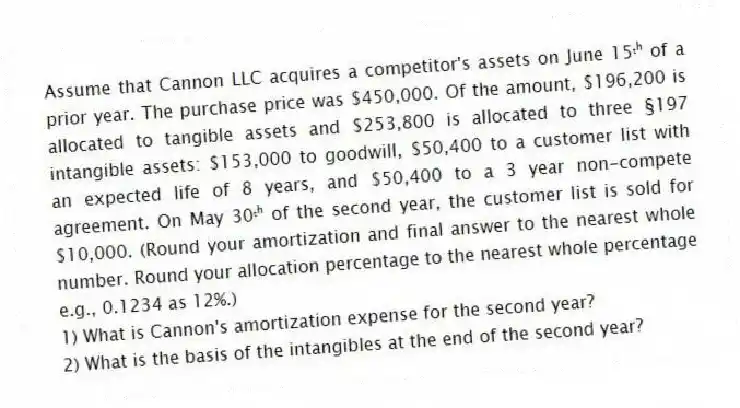

Assume that Cannon LLC acquires a competitor's assets on June 15ᵗʰ of a prior year. The purchase price was $450,000. Of the amount, $196,200 is allocated to tangible assets and $253,800 is allocated to three §197 intangible assets: $153,000 to goodwill, $50,400 to a customer list with an expected life of 8 years, and $50,400 to a 3 year non-compete agreement. On May 30ᵗʰ of the second year, the customer list is sold for $10,000. (Round your amortization and final answer to the nearest whole number. Round your allocation percentage to the nearest whole percentage e.g., 0.1234 as 12%.)

1) What is Cannon's amortization expense for the second year?

2) What is the basis of the intangibles at the end of the second year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q99: During August of the prior year, Julio

Q100: Yasmin purchased two assets during the current

Q101: Assume that Yuri acquires a competitor's assets

Q102: Paulman incurred $55,000 of research and experimental

Q104: Boxer LLC has acquired various types of

Q105: Patin Corporation began business on September 23ʳᵈ

Q106: PC Mine purchased a platinum deposit for

Q107: Alexandra purchased a $55,000 automobile during 2018.

Q108: Sequoia purchased the rights to cut timber

Q120: Phyllis purchased $8,000 of specialized audio equipment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents