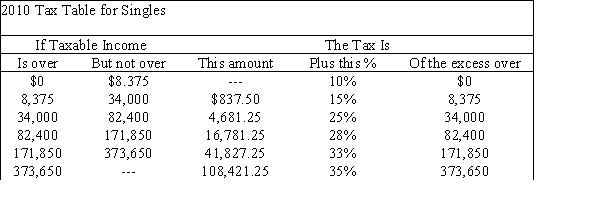

Below is the 2010 Tax Table for Singles.  In 2010 Alexa was single and had a total income of $36,000. She took a deduction of $5000 and had a tax credit of $1250. Calculate the tax owed by Alexa.

In 2010 Alexa was single and had a total income of $36,000. She took a deduction of $5000 and had a tax credit of $1250. Calculate the tax owed by Alexa.

A) $4231.25

B) $4043.75

C) $2981.25

D) $4462.50

Correct Answer:

Verified

Q61: Suppose the stock of Microsoft increases in

Q62: Suppose the buying power of the dollar

Q63: The rate of inflation in Ethiopia was

Q64: Suppose the rate of inflation this year

Q65: If a chair cost $100 in December

Q66: Below is the 2010 Tax Table for

Q67: Find the 5-year inflation rate in the

Q68: Below is the 2010 Tax Table for

Q69: Inflation rate is measured by the percentage

Q71: Below is the 2010 Tax Table for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents