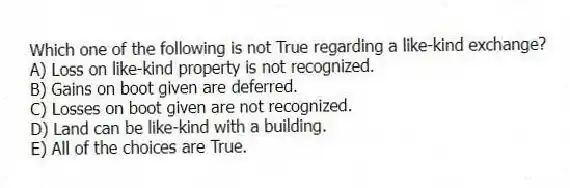

Which one of the following is not True regarding a like-kind exchange?

A) Loss on like-kind property is not recognized.

B) Gains on boot given are deferred.

C) Losses on boot given are not recognized.

D) Land can be like-kind with a building.

E) All of the choices are True.

Correct Answer:

Verified

Q61: Koch traded machine 1 for machine 2 when

Q62: Winchester LLC sold the following business assets

Q63: Why does §1250 recapture generally no longer

Q64: Brandon, an individual, began business four years

Q64: Which one of the following is not

Q65: Alpha sold machinery, which it used in

Q68: Which of the following is True regarding

Q70: Which of the following is not True

Q71: When does unrecaptured §1250 gains apply?

A) When

Q89: The general rule regarding the exchanged basis

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents