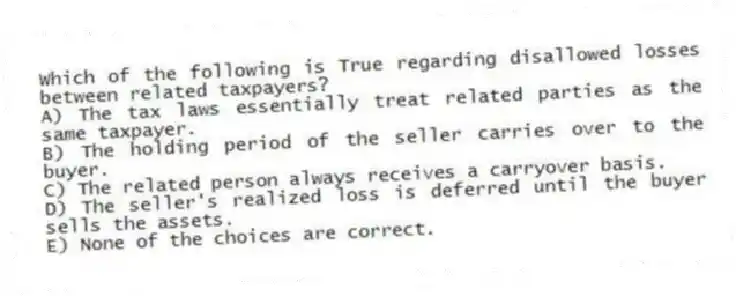

Which of the following is True regarding disallowed losses between related taxpayers?

A) The tax laws essentially treat related parties as the same taxpayer.

B) The holding period of the seller carries over to the buyer.

C) The related person always receives a carryover basis.

D) The seller's realized loss is deferred until the buyer sells the assets.

E) None of the choices are correct.

Correct Answer:

Verified

Q80: Mary exchanged an office building used in her

Q81: Explain whether the sale of a machine

Q82: Sadie sold 10 shares of stock to

Q83: Manassas purchased a computer several years ago

Q84: Sandra sold some equipment for $10,000 in

Q86: Which of the following is not True

Q87: Gainesville LLC sold the following business assets

Q88: Andrea sold a piece of machinery she

Q90: Andrew, an individual, began business four years

Q103: Frederique sold furniture that she uses in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents