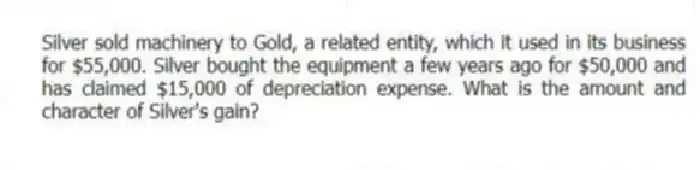

Silver sold machinery to Gold, a related entity, which it used in its business for $55,000. Silver bought the equipment a few years ago for $50,000 and has claimed $15,000 of depreciation expense. What is the amount and character of Silver's gain?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q83: Jessie sold a piece of land held

Q85: Peroni Corporation sold a parcel of land

Q93: Bull Run sold a computer for $1,200

Q93: Which of the following may qualify as

Q94: Buzz Corporation sold an office building that

Q106: Alexandra sold equipment that she uses in

Q109: Brandy sold a rental house that she

Q111: Sunshine LLC sold furniture for $75,000. Sunshine

Q126: Redoubt LLC exchanged an office building used

Q129: Kristi had a business building destroyed in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents