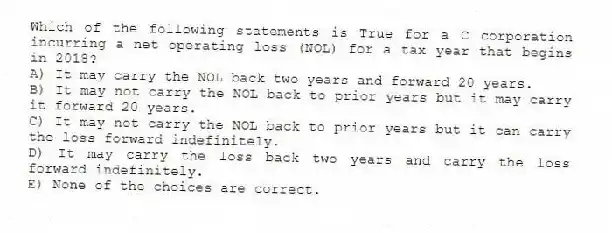

Which of the following statements is True for a C corporation incurring a net operating loss (NOL) for a tax year that begins in 2018?

A) It may carry the NOL back two years and forward 20 years.

B) It may not carry the NOL back to prior years but it may carry it forward 20 years.

C) It may not carry the NOL back to prior years but it can carry the loss forward indefinitely.

D) It may carry the loss back two years and carry the loss forward indefinitely.

E) None of the choices are correct.

Correct Answer:

Verified

Q44: Explanation: Owners of unincorporated entities can be

Q45: If C corporations retain their after-tax earnings,

Q53: Robert is seeking additional capital to expand

Q56: On which tax form does a single-member

Q57: Which tax classifications can potentially apply to

Q60: Logan, a 50 percent shareholder in Military

Q62: Jorge is a 100 percent owner of

Q64: In its first year of existence (2018),

Q75: For which type of entity does the

Q79: The excess loss limitations apply to owners

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents