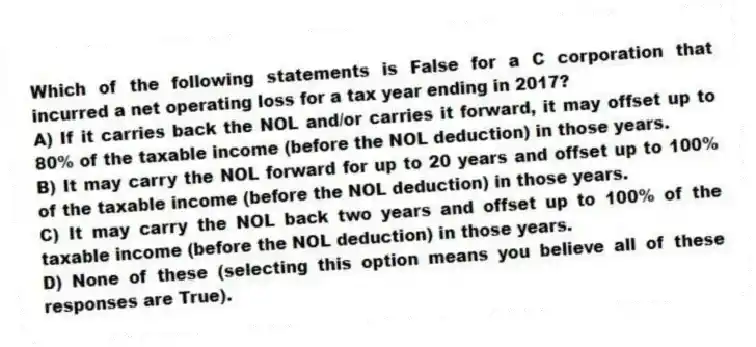

Which of the following statements is False for a C corporation that incurred a net operating loss for a tax year ending in 2017?

A) If it carries back the NOL and/or carries it forward, it may offset up to 80% of the taxable income (before the NOL deduction) in those years.

B) It may carry the NOL forward for up to 20 years and offset up to 100% of the taxable income (before the NOL deduction) in those years.

C) It may carry the NOL back two years and offset up to 100% of the taxable income (before the NOL deduction) in those years.

D) None of these (selecting this option means you believe all of these responses are True) .

Correct Answer:

Verified

Q32: On which form is income from a

Q43: When an employee/shareholder receives a business income

Q45: If C corporations retain their after-tax earnings,

Q47: What tax year-end must an unincorporated entity

Q48: Roberto and Reagan are both 25 percent

Q50: Crocker and Company (CC)is a C corporation.

Q51: On which tax form do LLCs with

Q54: Which of the following legal entities are

Q56: On which tax form does a single-member

Q57: The deduction for qualified business income applies

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents