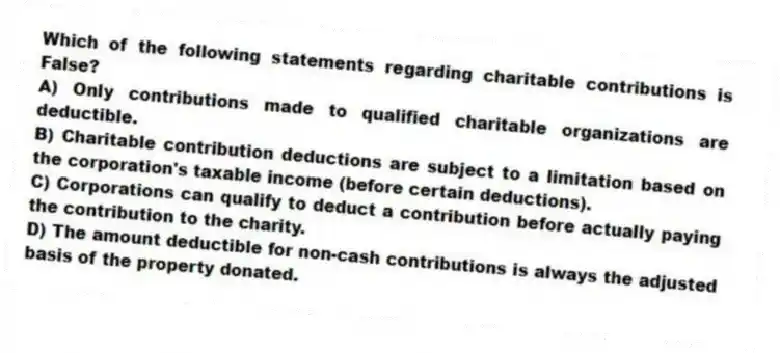

Which of the following statements regarding charitable contributions is False?

A) Only contributions made to qualified charitable organizations are deductible.

B) Charitable contribution deductions are subject to a limitation based on the corporation's taxable income (before certain deductions) .

C) Corporations can qualify to deduct a contribution before actually paying the contribution to the charity.

D) The amount deductible for non-cash contributions is always the adjusted basis of the property donated.

Correct Answer:

Verified

Q59: Which of the following is not calculated

Q59: Which of the following statements regarding book-tax

Q62: Which of the following statements regarding excess

Q62: Which of the following is deductible in

Q63: Tatoo Inc. reported a net capital loss

Q67: In January 2017, Khors Company issued nonqualified

Q68: Canny Foods Co. is considering three ways

Q69: For corporations, which of the following regarding

Q86: Remsco has taxable income of $60,000 and

Q94: If a corporation's cash charitable contributions exceed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents