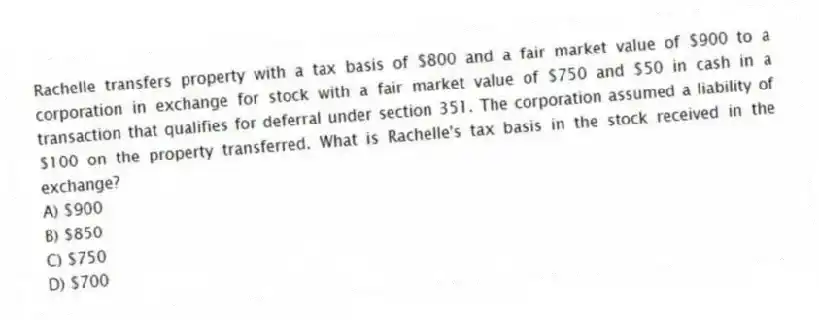

Rachelle transfers property with a tax basis of $800 and a fair market value of $900 to a corporation in exchange for stock with a fair market value of $750 and $50 in cash in a transaction that qualifies for deferral under section 351. The corporation assumed a liability of $100 on the property transferred. What is Rachelle's tax basis in the stock received in the exchange?

A) $900

B) $850

C) $750

D) $700

Correct Answer:

Verified

Q29: A liquidated corporation will always recognize gain

Q30: Which of the following amounts is not

Q44: Which of the following statements best describes

Q46: Which of the following statements best describes

Q51: Amy transfers property with a tax basis

Q56: Which of the following statements does not

Q58: Inez transfers property with a tax basis

Q64: Which of the following statements best describes

Q72: Jasmine transferred 100 percent of her stock

Q74: Which of the following statements best describes

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents