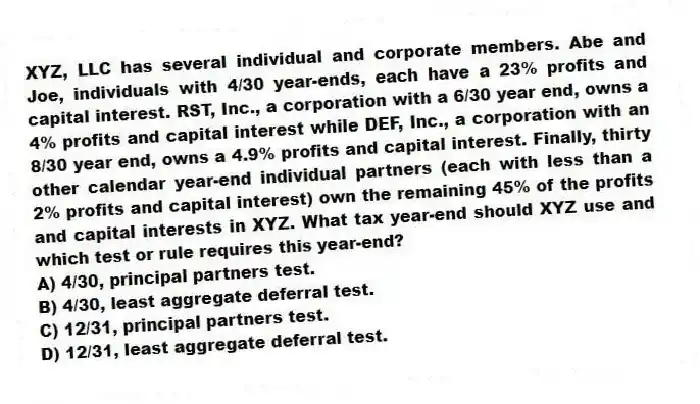

XYZ, LLC has several individual and corporate members. Abe and Joe, individuals with 4/30 year-ends, each have a 23% profits and capital interest. RST, Inc., a corporation with a 6/30 year end, owns a 4% profits and capital interest while DEF, Inc., a corporation with an 8/30 year end, owns a 4.9% profits and capital interest. Finally, thirty other calendar year-end individual partners (each with less than a 2% profits and capital interest) own the remaining 45% of the profits and capital interests in XYZ. What tax year-end should XYZ use and which test or rule requires this year-end?

A) 4/30, principal partners test.

B) 4/30, least aggregate deferral test.

C) 12/31, principal partners test.

D) 12/31, least aggregate deferral test.

Correct Answer:

Verified

Q44: Which of the following would not be

Q46: This year, HPLC, LLC was formed by

Q47: What is the rationale for the specific

Q47: A partner's self-employment earnings (loss) may be

Q48: How does a partnership make a tax

Q49: For partnership tax years ending after December

Q53: Which of the following items are subject

Q54: Which of the following statements regarding the

Q55: Which of the following items are subject

Q61: Frank and Bob are equal members in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents