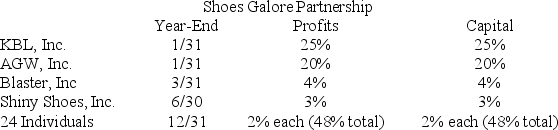

KBL, Inc., AGW, Inc., Blaster, Inc., Shiny Shoes, Inc., and a group of 24 individuals form Shoes Galore General Partnership on October 11, 20X9. Now, Shoes Galore must adopt its required tax year-end. The partners' year-ends, profits interests, and capital interests are reflected in the table below. Given this information, what tax year-end must Shoes Galore use and what rule requires this year-end?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q79: Jerry, a partner with 30% capital and

Q80: If a taxpayer sells a passive activity

Q81: Lloyd and Harry, equal partners, form the

Q82: Ruby's tax basis in her partnership interest

Q84: At the end of year 1, Tony

Q85: J&J, LLC was in its third year

Q86: On April 18, 20X8, Robert sold his

Q87: Illuminating Light Partnership had the following revenues,

Q88: On June 12, 20X9, Kevin, Chris, and

Q90: Jay has a tax basis of $14,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents