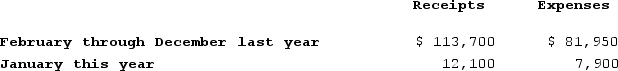

David purchased a deli shop on February 1st of last year and began to operate it as a sole proprietorship. David reports his personal taxes using the cash method over a calendar year, and he wants to use the cash method and fiscal year for his sole proprietorship. He has summarized his receipts and expenses through January 31st of this year as follows:

What income should David report from his sole proprietorship?

What income should David report from his sole proprietorship?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q83: Manley operates a law practice on the

Q97: Jones operates an upscale restaurant and he

Q98: Which of the following is NOT considered

Q98: Bryon operates a consulting business and he

Q100: Judy is a self-employed musician who performs

Q103: Mike operates a fishing outfitter as an

Q106: Rock Island Corporation generated taxable income (before

Q107: Anne is a self-employed electrician who reports

Q116: Sandy Bottoms Corporation generated taxable income (before

Q117: Sandy Bottoms Corporation generated taxable income (before

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents