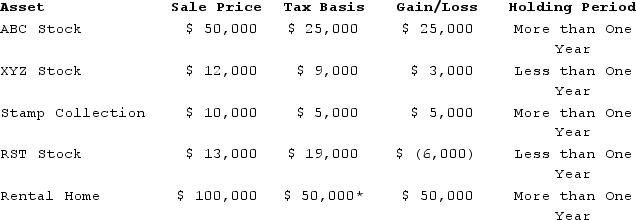

Henry, a single taxpayer with a marginal tax rate of 35 percent(taxable income is $300,000 before considering any of the items below), sold the following assets during the year:

*$25,000 of the gain is a 25 percent gain. The remaining gain is 0/15/20 percent gain.

*$25,000 of the gain is a 25 percent gain. The remaining gain is 0/15/20 percent gain.

What tax rate(s)will apply to Henry's capital gains or losses?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q55: Which taxpayer would not be considered a

Q60: Bob Brain files a single tax return

Q65: On the sale of a passive activity,

Q66: Scott Bean is a computer programmer and

Q67: Michelle is an active participant in the

Q69: Scott Bean is a computer programmer and

Q71: How are individual taxpayers' investment expenses and

Q72: What are the rules limiting the amount

Q74: A taxpayer's at-risk amount in an activity

Q79: What is the tax treatment for qualified

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents