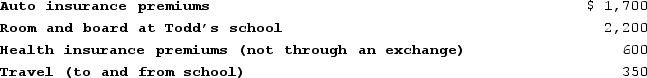

Ned is a head of household with a dependent son, Todd, who is a full-time student. This year Ned made the following expenditures related to Todd's support:  What amount can Ned include in his itemized deductions?

What amount can Ned include in his itemized deductions?

A) $1,700 included in Ned's other itemized deductions

B) $2,050 included in Ned's other itemized deductions

C) $950 included in Ned's other itemized deductions

D) $600 included in Ned's medical expenses

E) None of the choices are correct.

Correct Answer:

Verified

Q24: Bunching itemized deductions is one form of

Q29: Taxpayers are allowed to deduct mortgage interest

Q32: Taxpayers filing single and taxpayers filing married

Q38: Which of the following is a true

Q40: In general, taxpayers are allowed to deduct

Q44: Which of the following taxes will not

Q45: Hector is a married, self-employed taxpayer, and

Q48: Bruce is employed as an executive and

Q53: Mason paid $4,100 of interest on a

Q54: Which of the following costs are deductible

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents