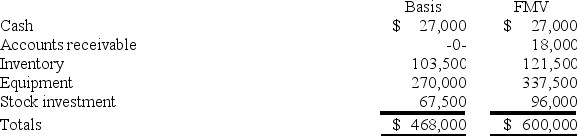

Zayde is a 1/3 partner in the ARZ partnership with an outside basis of $156,000 on January 1. Zayde sells his partnership interest to Thomas on January 1ˢᵗ for $180,000 cash. The ARZ Partnership has the following assets and no liabilities as of January 1:

The equipment was purchased for $360,000 and the partnership has taken $90,000 of depreciation. The stock was purchased 3 years ago. What is the amount and character of Zayde's gain or loss on the sale of his partnership interest?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q72: Tyson is a 25% partner in the

Q73: Victor is a 1/3 partner in the

Q74: Joan is a 1/3 partner in the

Q75: Daniela is a 25% partner in the

Q76: The VRX Partnership (a calendar year-end entity)

Q78: Kathy is a 25% partner in the

Q79: Kathy purchases a one-third interest in the

Q80: Brian is a 25% partner in the

Q81: Katrina is a one-third partner in the

Q82: Lola is a 35% partner in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents