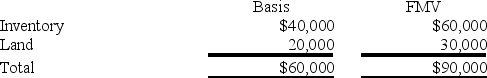

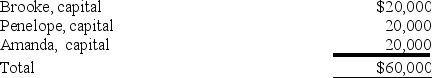

BPA Partnership is an equal partnership in which each of the partners has a basis in her partnership interest of $20,000. BPA reports the following balance sheet:

a. Identify the hot assets if Brooke decides to sell her interest in BPA.

b. Are these assets "hot" for purposes of distributions?

c. If BPA distributes the land to Brooke in complete liquidation of her partnership interest, what tax issues should be considered?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q85: Esther and Elizabeth are equal partners in

Q88: Nadine Fimple is a one-half partner in

Q89: Carmello is a one-third partner in the

Q91: Doris owns a 1/3 capital and profits

Q93: Heidi and Teresa are equal partners in

Q93: Lola is a 35% partner in the

Q95: Nadine Fimple is a one-third partner in

Q96: Heidi and Teresa are equal partners in

Q106: Tyson, a one-quarter partner in the TF

Q115: Tyson, a one-quarter partner in the TF

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents