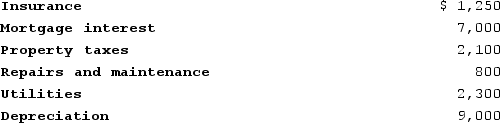

Rayleen owns a condominium near Orlando, Florida. This year, she incurs the following expenses in connection with her condo:

During the year, Rayleen rented the condo for 130 days and she received $25,000 of rental receipts. She did not use the condo at all for personal purposes during the year. Rayleen is considered to be an active participant in the property. Rayleen's AGI from all sources other than the rental property is $130,000. Rayleen does not have passive income from any other sources. What is Rayleen's AGI after accounting for the rental property?

During the year, Rayleen rented the condo for 130 days and she received $25,000 of rental receipts. She did not use the condo at all for personal purposes during the year. Rayleen is considered to be an active participant in the property. Rayleen's AGI from all sources other than the rental property is $130,000. Rayleen does not have passive income from any other sources. What is Rayleen's AGI after accounting for the rental property?

Correct Answer:

Verified

$...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q88: Jamison is self-employed and he works out

Q89: Harriet owns a second home that she

Q94: For a home to be considered a

Q98: When a taxpayer experiences a net loss

Q103: Kristen rented out her home for 5

Q105: Darren (single)purchased a home on January 1,

Q106: Careen owns a condominium near Newport Beach

Q107: Tyson owns a condominium near Laguna Beach,

Q113: Amelia is looking to refinance her home

Q117: Leticia purchased a home on July 1,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents