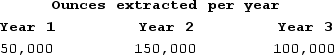

Lucky Strike Mine (LLC) purchased a silver deposit for $1,500,000. It estimated it would extract 500,000 ounces of silver from the deposit. Lucky Strike mined the silver and sold it, reporting gross receipts of $1.8 million, $2.5 million, and $2 million for Years 1 through 3, respectively. During Years 1 through 3, Lucky Strike reported net income (loss) from the silver deposit activity in the amount of ($100,000) , $400,000, and $100,000, respectively. In Years 1 through 3, Lucky Strike actually extracted 300,000 ounces of silver as follows:  What is Lucky Strike's depletion deduction for Year 2 if the applicable percentage depletion for silver is 15 percent?

What is Lucky Strike's depletion deduction for Year 2 if the applicable percentage depletion for silver is 15 percent?

A) $200,000

B) $375,000

C) $400,000

D) $450,000

E) None of the choices are correct.

Correct Answer:

Verified

Q83: Santa Fe purchased the rights to extract

Q84: Assume that Bethany acquires a competitor's assets

Q87: Santa Fe purchased the rights to extract

Q90: Assume that Brittany acquires a competitor's assets

Q90: Jorge purchased a copyright for use in

Q91: Racine started a new business in the

Q91: Daschle LLC completed some research and development

Q92: Jasmine started a new business in the

Q92: Jasmine started a new business in the

Q100: Jorge purchased a copyright for use in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents