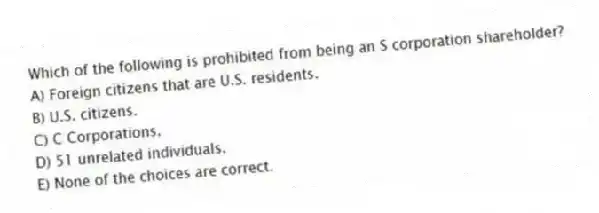

Which of the following is prohibited from being an S corporation shareholder?

A) Foreign citizens that are U.S. residents.

B) U.S. citizens.

C) C Corporations.

D) 51 unrelated individuals.

E) None of the choices are correct.

Correct Answer:

Verified

Q27: Distributions to owners may not cause the

Q40: S corporations are treated in part like

Q41: If Annie and Andy (each a 30%

Q43: S corporation distributions of cash are not

Q44: The built-in gains tax does not apply

Q45: If Annie and Andy (each a 30%

Q48: Which of the following would not result

Q48: S corporations are required to file Form

Q49: Which of the following is not considered

Q59: C corporations that elect S corporation status

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents