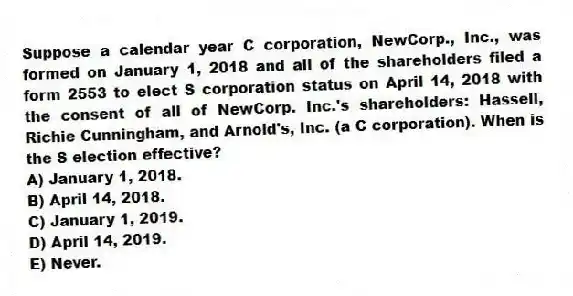

Suppose a calendar year C corporation, NewCorp., Inc., was formed on January 1, 2018 and all of the shareholders filed a form 2553 to elect S corporation status on April 14, 2018 with the consent of all of NewCorp. Inc.'s shareholders: Hassell, Richie Cunningham, and Arnold's, Inc. (a C corporation) . When is the S election effective?

A) January 1, 2018.

B) April 14, 2018.

C) January 1, 2019.

D) April 14, 2019.

E) Never.

Correct Answer:

Verified

Q43: S corporations generally recognize gain or loss

Q44: The built-in gains tax does not apply

Q45: S corporations without earnings and profits from

Q48: S corporations are required to file Form

Q49: Which of the following is not considered

Q52: The estimated tax payment rules for S

Q53: Built-in gains recognized fifteen years after a

Q56: Which of the following is a requirement

Q57: During the post-termination transition period, property distributions

Q59: C corporations that elect S corporation status

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents