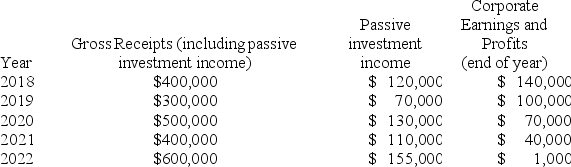

Neal Corporation was initially formed as a C corporation with a calendar year end. Neal elected S corporation status, effective January 1, 2018. On December 31, 2017, Neal Corp. reported earnings and profits of $150,000. Beginning in 2018, Neal Corp. reported the following information. Does Neal Corp.'s S election terminate due to excess net passive income? If so, what is the effective date of the termination?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q107: Maria resides in San Antonio, Texas. She

Q113: Maria, a resident of Mexico City, Mexico,

Q114: Jason is one of 100 shareholders in

Q114: Shea is a 100% owner of Mets

Q116: XYZ Corporation (an S corporation) is owned

Q120: Jackson is the sole owner of JJJ

Q121: During 2018, CDE Corporation (an S corporation

Q122: RGD Corporation was a C corporation from

Q123: During 2018, MVC operated as a C

Q124: Hector formed H Corporation as a C

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents