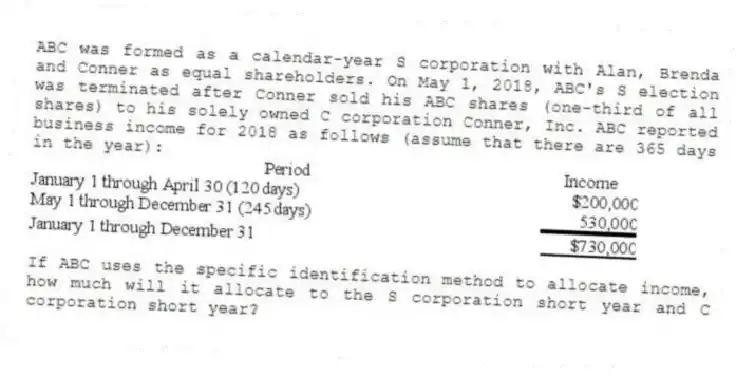

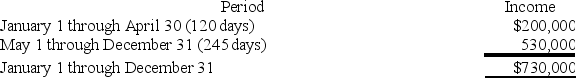

ABC was formed as a calendar-year S corporation with Alan, Brenda and Conner as equal shareholders. On May 1, 2018, ABC's S election was terminated after Conner sold his ABC shares (one-third of all shares) to his solely owned C corporation Conner, Inc. ABC reported business income for 2018 as follows (assume that there are 365 days in the year):

If ABC uses the specific identification method to allocate income, how much will it allocate to the S corporation short year and C corporation short year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q98: Clampett, Inc. converted to an S corporation

Q99: Assume that at the end of 2018,

Q100: Clampett, Inc. has been an S corporation

Q101: ABC Corp. elected to be taxed as

Q102: Jackson is the sole owner of JJJ

Q102: Which of the following statements is correct?

A)The

Q104: CB Corporation was formed as a calendar-year

Q105: ABC was formed as a calendar-year S

Q108: Which of the following statements is correct

Q115: AIRE was initially formed as an S

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents