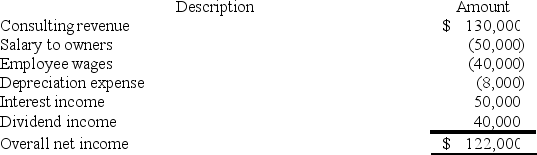

RGD Corporation was a C corporation from its inception in 2014 through 2017. However, it elected S corporation status effective January 1, 2018. RGD had $50,000 of earnings and profits at the end of 2017. RGD reported the following information for its 2018 tax year.

What amount of excess net passive income tax is RGD liable for in 2018? (Round your answer for excess net passive income to the nearest thousand).

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q124: Hector formed H Corporation as a C

Q125: SEC Corporation has been operating as a

Q126: During 2018, CDE Corporation (an S corporation

Q127: During 2018, CDE Corporation (an S corporation

Q128: Hazel is the sole shareholder of Maple

Q129: Lamont is a 100% owner of JKL

Q130: SEC Corporation has been operating as a

Q132: MWC is a C corporation that uses

Q133: During 2018, MVC operated as a C

Q134: Vanessa is the sole shareholder of V

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents