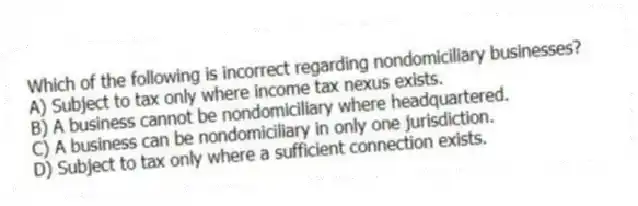

Which of the following is incorrect regarding nondomiciliary businesses?

A) Subject to tax only where income tax nexus exists.

B) A business cannot be nondomiciliary where headquartered.

C) A business can be nondomiciliary in only one jurisdiction.

D) Subject to tax only where a sufficient connection exists.

Correct Answer:

Verified

Q40: Several states are now moving from a

Q43: Most services are sourced to the state

Q45: Which of the items is correct regarding

Q50: Which of the following sales is always

Q50: All of the following are False regarding

Q51: Rental income is allocated to the state

Q52: Which of the following regarding the state

Q53: A gross receipts tax is subject to

Q54: Interest and dividends are allocated to the

Q57: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents