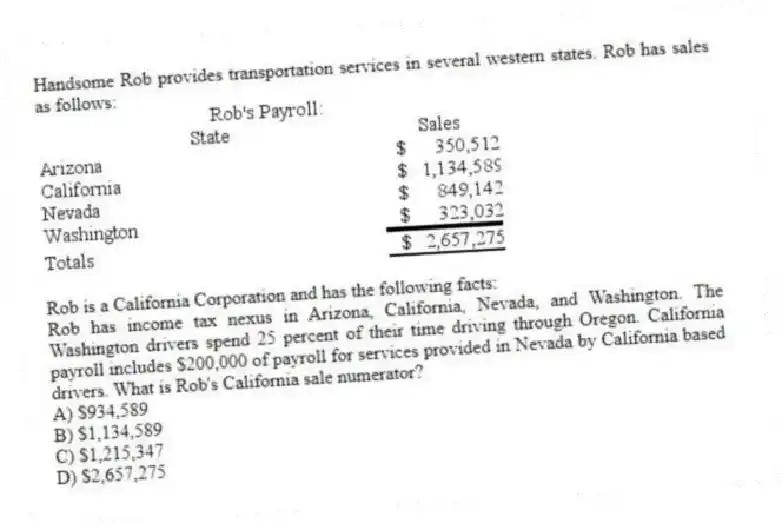

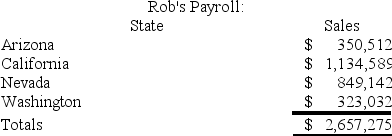

Handsome Rob provides transportation services in several western states. Rob has sales as follows:

Rob is a California Corporation and has the following facts:

Rob has income tax nexus in Arizona, California, Nevada, and Washington. The Washington drivers spend 25 percent of their time driving through Oregon. California payroll includes $200,000 of payroll for services provided in Nevada by California based drivers. What is Rob's California sale numerator?

A) $934,589

B) $1,134,589

C) $1,215,347

D) $2,657,275

Correct Answer:

Verified

Q85: Mighty Manny, Incorporated manufactures and services deli

Q87: Which of the following is not a

Q89: Wacky Wendy produces gourmet cheese in Wisconsin.

Q90: Gordon operates the Tennis Pro Shop in

Q92: Which of the following is not a

Q93: Super Sadie, Incorporated manufactures sandals and distributes

Q96: Discuss the steps necessary to determine whether

Q96: Which of the following is not a

Q97: Della Corporation is headquartered in Carlisle, Pennsylvania.

Q100: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents