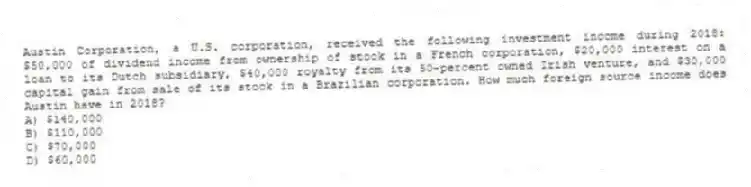

Austin Corporation, a U.S. corporation, received the following investment income during 2018: $50,000 of dividend income from ownership of stock in a French corporation, $20,000 interest on a loan to its Dutch subsidiary, $40,000 royalty from its 50-percent owned Irish venture, and $30,000 capital gain from sale of its stock in a Brazilian corporation. How much foreign source income does Austin have in 2018?

A) $140,000

B) $110,000

C) $70,000

D) $60,000

Correct Answer:

Verified

Q1: All income earned by a Swiss corporation

Q24: Which statement best describes the U.S. framework

Q30: Ames Corporation has a precredit U.S. tax

Q30: Which statement best describes the U.S. framework

Q32: All passive income earned by a CFC

Q33: Which of the following statements best describes

Q35: To be eligible for the "closer connection"

Q38: Russell Starling, an Australian citizen and resident,

Q39: Under which of the following scenarios could

Q40: Which statement best describes the U.S. framework

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents